Boral gets SBTi approval for 2030 Emissions Reduction Targets

Boral’s sector-leading climate targets validated by the Science Based Targets initiative

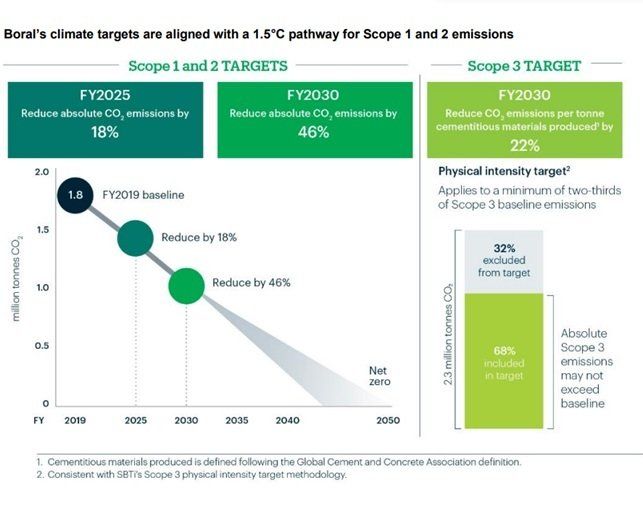

Boral today announced that its ambitious emissions reduction targets for 2030 have been approved by the Science Based Targets initiative (SBTi) as consistent with the levels required to meet the goals of the Paris Agreement.

Boral unveiled its emissions reduction targets and made a commitment to net-zero emissions by no later than 20501 in August this year, and subsequently joined the SBTi’s Business Ambition for 1.5°C and UNFCCC Race to Zero.

Boral’s Chief Finance & Strategy Officer, Tino La Spina, said:

“Boral was the first company in the global cement sector to set 2030 science-based targets aligned with a 1.5°C pathway for Scope 1 and 2 emissions.2

“As Australia’s largest integrated construction materials company, we believe it is important that we accelerate the transition to a net zero future in the construction materials industry by reducing our carbon footprint and by offering product solutions to our customers to build more sustainable buildings and infrastructure.

“Receiving SBTi’s approval of our 2030 emissions reduction targets provides independent verification our ambitious targets are aligned with the goals of the Paris Agreement.”

Boral’s 2030 target to reduce its Scope 1 and 2 emissions by 46 per cent is consistent with the most ambitious goal of the Paris Agreement to limit global warming to 1.5°C. Its 2030 target to reduce its relevant Scope 3 emissions3 per tonne of cementitious materials by 22 per cent meets the SBTi criteria for value chain goals.

The emissions reduction targets are underpinned by five key decarbonisation levers, with work underway on initiatives across each of these levers. These will see the Company:

- transition to 100 per cent renewable electricity by 2025 and increase alternative fuels at its Berrima Cement kiln

- grow the proportion of revenue from its leading lower carbon concrete product range and optimize the efficiency of its cement plant

- reduce transport emissions in its own and contractor fleet

- prioritise lower carbon intensity suppliers, and

- explore and test emerging carbon capture use and storage technologies.

In addition to supporting the global transition to a low carbon economy, these decarbonisation efforts will enhance Boral’s competitive position and support its customers’ sustainability priorities.

Mr La Spina added:

“Boral is determined to become a leading innovator in sustainability through decarbonisation of cement and concrete and increasing our contribution to a more circular economy.

“We continue to support our customers in their transition to net zero, broadening our range of highperforming lower carbon concrete products to cater for all building and infrastructure applications, and offering Climate Active−certified net carbon neutral concrete.

“We’re excited about the journey ahead, as we focus on delivering future growth while contributing to a more sustainable future.”

- While SBTi’s methodology permits the use of carbon offsets to achieve net-zero emissions post-2030, our decarbonisation pathway post-2030 is focused on achieving absolute emissions reductions for Scopes 1, 2 and 3. This pathway remains dependent on further development and commercial viability of new and emerging technologies.

- Based on construction materials, including cement, companies taking action through SBTi.

- Refers to 68% of Boral’s Scope 3 emissions included in its Scope 3 target.